Embarking on the journey of homeownership is an exciting milestone, and for first-time buyers in Canada, the new GST rebate for new homes offers a significant advantage.- This valuable program provides substantial financial relief by allowing eligible individuals to recover a portion of the Goods and Services Tax (GST) paid on the purchase of a newly constructed home. This means more money stays in your pocket, directly reducing the upfront costs of buying, which can be a game-changer in today's housing market.

- By offsetting a considerable amount of the sales tax, the GST rebate makes new homeownership more accessible and affordable, empowering you to step onto the property ladder with greater confidence.

- Key Points

- Eligibility:

Must be a first-time home buyer (not owned a home in the current or previous four years).

Must be at least 18 years old and a Canadian citizen or permanent resident.

Applies to purchases of new homes from a builder, new homes built on owned/leased land, or shares in a co-op housing corporation.

The agreement of purchase and sale must be entered into after May 26, 2025, and before 2031.

Rebate Structure:

100% GST rebate for new homes priced up to $1 million (maximum rebate of $50,000).

Partial rebate for homes priced between $1 million and $1.5 million (rebate phases out linearly).

No rebate for homes priced at $1.5 million or more.

How It’s Applied:

The rebate can be claimed directly or assigned to the builder, who may reduce the purchase price by the rebate amount.

The home must be intended as your primary residence and you must be the first occupant.

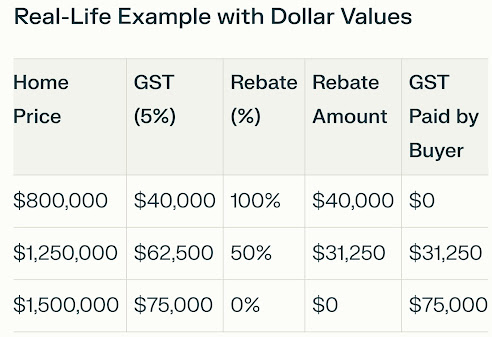

Example 1:

You buy a new home for $800,000.

GST would normally be $40,000.

As a first-time buyer, you get a 100% rebate: you pay $0 GST.

Example 2:

You buy a new home for $1,250,000.

GST would normally be $62,500.

The rebate is 50% (midway between $1M and $1.5M): you get $31,250 back, so you pay $31,250 GST.

Example 3:

You buy a new home for $1,500,000.

GST would normally be $75,000.

No rebate applies: you pay the full $75,000 GST.

Additional Notes

The rebate is only for the federal GST portion, not for provincial sales tax.

The program is set to run for agreements entered into between May 27, 2025, and before 2031, with construction to begin before 2031.

The rebate is not available if you or your spouse/common-law partner owned and lived in a home in the last four calendar years.

If the thought of a substantial rebate helping affordability is making you consider a new build, reach out to me today! I've spent years working in New Construction. 😄

No comments:

Post a Comment